Why Dyson's Chinese Market Entry Was so Successful

Dyson, founded in 1991 by inventor Sir James Dyson, is a British technology company renowned for revolutionizing household technology. Known for groundbreaking vacuum cleaners, bladeless fans, and advanced hair care devices, Dyson sets new standards in innovation, sustainability, and design.

With the steady increase in income among the new generation of consumers and the significant potential for consumption upgrades among the middle class in China, traditional Chinese brands have struggled to meet the psychological needs of this group, who are enthusiastic about fashion and trend-following. This has led to a significant demand for high-end brands from Japan, South Korea, Europe, and the United States among the middle class.

Affordable Luxury Positioning and Product Seeding Campaigns

Dyson's strategic approach to market positioning in China is centered around the concept of "affordable luxury," a notion that resonates particularly well with the evolving preferences of a discerning consumer base.

By targeting niche segments of the market, Dyson caters to individuals who seek not just cutting-edge technology but also a touch of sophistication and elegance in their household appliances. This unique positioning distinguishes Dyson from traditional competitors and resonates with the aspirations of the high-end new middle-class consumer group, known for their penchant for both quality and style.

In addition to its precise market positioning, Dyson employs innovative product seeding campaigns as a cornerstone of its marketing strategy. These campaigns not only introduce the latest Dyson innovations but also generate significant buzz and anticipation among consumers.

By harnessing the power of influencers, tech enthusiasts, and trendsetters, Dyson strategically places its products at the forefront of consumer consciousness. This approach not only fosters brand loyalty but also fuels a sense of exclusivity and desirability around Dyson's offerings.

Dyson Online Promotion in China

Dyson is a strong advocate of seeding. When it entered the Chinese market in 2012, it focused on brand marketing with an emphasis on product technology through a content seeding approach.

Dyson opened a Weibo business account early on and used celebrities and influencers on Weibo to promote its products. It also initiated topics to attract the attention and engagement of netizens, strengthening consumer education about the Dyson brand, products, and new technology.

With the rise of the "super APP + content marketing + social media influencer" model, Dyson leveraged platforms like Xiaohongshu (AKA RED or Little Red Book) and Douyin (Chinese version of TikTok) to create a buzz around its products.

It utilized social media KOLs, celebrities, and opinion leaders for word-of-mouth marketing, adding elements like "high-end" and "elegance" to its products, in addition to its existing "cutting-edge technology" label. Dyson successfully positioned itself as a premium product similar to Apple phones and luxury bags, carrying social status connotations.

At the same time, Dyson implemented a comprehensive digital marketing strategy in the Chinese market, covering official websites, portals, search engines, social media, forums, videos, e-commerce, and tips sharing.

Dyson Offline Marketing in China

For Dyson, pop-up stores are very important because they allow more consumers to see, touch, and use Dyson products. Pop-up stores are a key element of Dyson's offline marketing strategy. Even before entering the Chinese market, Dyson had extensive experience with pop-up stores in foreign markets.

Leveraging the technological prowess of its products, Dyson had already established a strong presence in the high-end markets of Europe, the United States, Japan, and others. After entering the Chinese market, Dyson opened various types of pop-up stores in major shopping centers across the country and developed a pop-up store marketing strategy tailored to the Chinese market. Contrary to common perception, Dyson actually began its journey in the Chinese market as early as 2006 when it tested the Chinese market with its high-speed hand dryer, though it faced challenges.

In 2012, Dyson re-entered the Chinese market, and its products, known for their aesthetics and technological appeal, became a new star in the high-end smart home appliance market.

In 2016, Dyson increased its investment in the Chinese market, launched a comprehensive offline expansion, and initiated its pop-up store plan.

By 2018, the number of pop-up stores had increased from 60 to over 400, and simultaneously, the smart hardware market witnessed rapid growth.

As of the end of 2019, Dyson had established a network of approximately 800 Dyson stores covering 90 cities across the country.

For Dyson, pop-up stores are essential because they allow more consumers to see, touch, and use Dyson products.

Once a city is selected, Dyson first looks for locations where the target consumers tend to shop. Large shopping malls are the preferred choice for Dyson. Apart from popular large shopping centers like Wanda Plaza, Lai Fung Plaza, and Tianhe, Dyson also favors small, distinctive supermarkets such as Kaishike and Sam's Club.

For each specific event in a city, Dyson calculates the number of demos (each time a customer tries a product) expected to be achieved throughout the year to determine the specific number of event locations needed. Dyson's strategy of opening a large number of stores allows it to cover various types of locations, and it also serves as a test of the surrounding commercial environment, target demographics, and mall foot traffic. Based on feedback from a large number of pop-up stores, Dyson determines the best locations for future flagship stores.

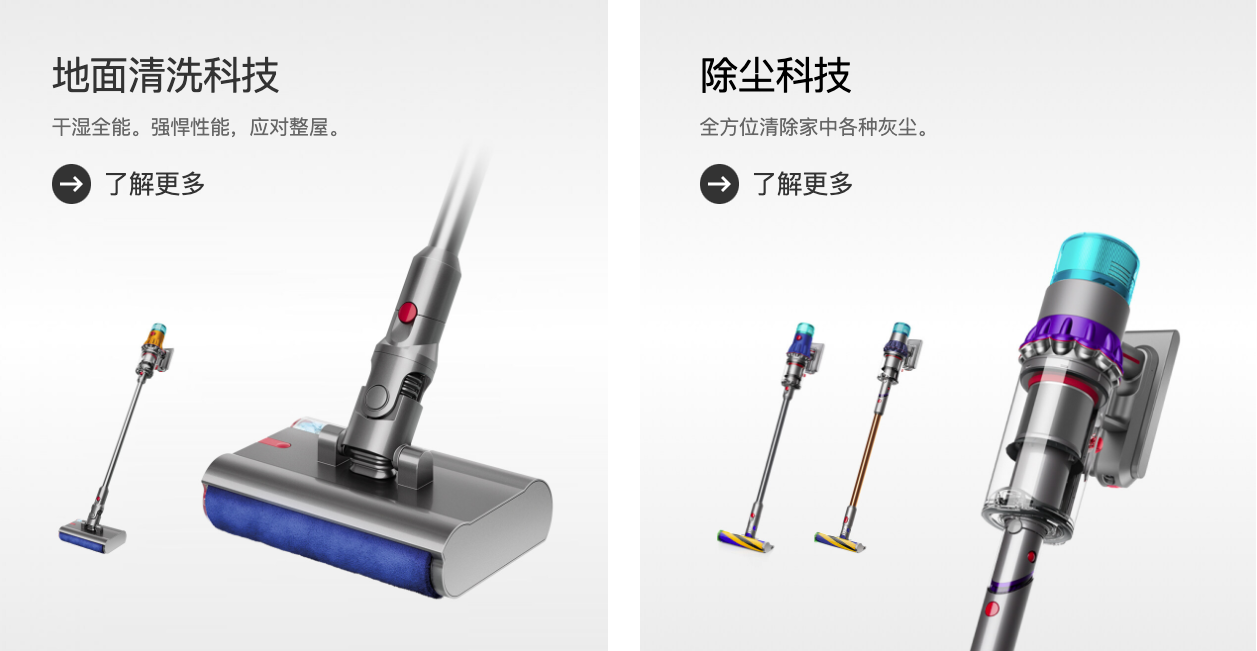

Today, with the pace of life accelerating and the rise of the "lazy economy" in China, cleaning appliances dedicated to freeing up users' hands have become increasingly popular. While vacuum cleaners have seen some growth in the first half of the year, especially in the context of the "lazy economy" they have faced competition from emerging categories such as robotic vacuum cleaners and floor washing machines.

According to reliable data sources, sales in the vacuum cleaner market in the first half of the year increased compared to the second half of the previous year. However, looking at the same period compared to the previous year, overall sales and revenue in the vacuum cleaner market have declined to some extent. Nevertheless, Dyson remains a leading brand in the vacuum cleaner market, holding a majority of the market share. Dyson sold nearly 230,000 vacuum cleaners in the first half of the year, with sales revenue exceeding 600 million yuan, and a market share of over 46%.

If you're interested in the Chinese market or need Chinese social media content support, feel free to reach out to our Lotus Social team. We're here to assist you on your journey to success in this dynamic landscape. Don't hesitate to get in touch!